F&M BANK (FMBM)·Q4 2025 Earnings Summary

F&M Bank Corp Posts Record 2025 Earnings as NIM Expansion Drives 53% Profit Growth

February 2, 2026 · by Fintool AI Agent

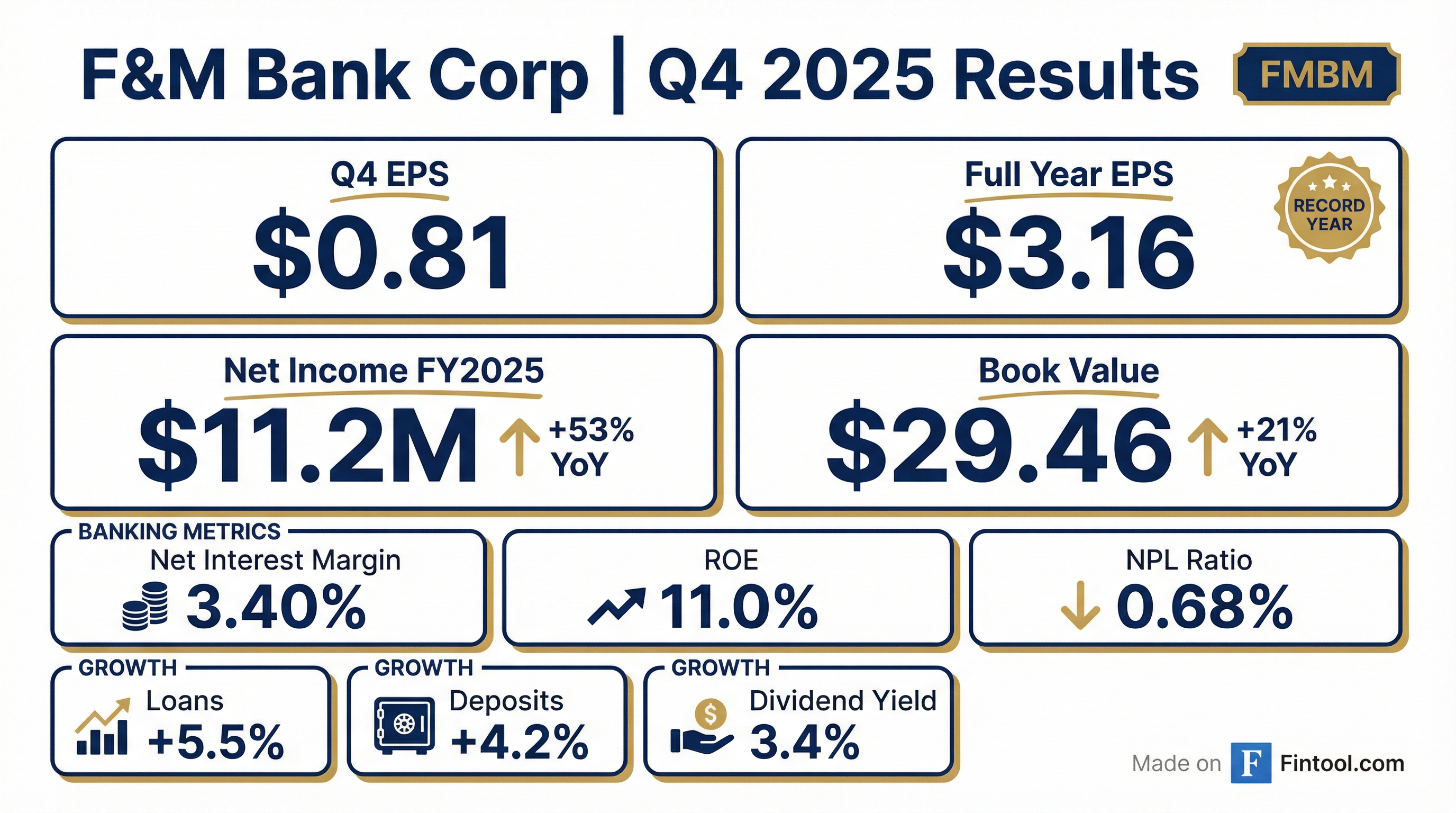

F&M Bank Corp (OTCQX: FMBM), the Virginia-based community bank holding company, reported Q4 2025 net income of $2.88 million ($0.81 per share), capping a record year with full-year earnings of $11.2 million ($3.16 per share) — a 53% increase over 2024.

The Shenandoah Valley-headquartered bank credited net interest margin expansion, disciplined expense management, and steady loan growth for the record performance. Book value per share surged 20.6% year-over-year to $29.46.

Did F&M Bank Corp Beat Earnings?

No analyst coverage exists for FMBM. As a small community bank traded on the OTCQX market (~$109M market cap), F&M Bank does not have sell-side analyst estimates for revenue or EPS. Performance must be evaluated against historical trends rather than consensus expectations.

For the full year 2025, the company reported record net income of $11.2 million ($3.16 per share) compared to $7.3 million ($2.07 per share) in 2024 — an improvement of $3.9 million or 53%.

What Drove the Record Performance?

Net Interest Margin Expansion

The primary earnings driver was margin expansion. Full-year NIM improved 57 basis points to 3.35% from 2.78% in 2024, as earning asset yields rose 18 bps to 5.46% while cost of funds declined 36 bps to 2.15%.

The decline in funding costs was driven by a $2.6 million decrease in deposit interest expense due to a favorable shift from time deposits to money market accounts, plus a $1.9 million reduction in short-term debt interest.

Loan and Balance Sheet Growth

Total loans reached $886.3 million at year-end, up $46.3 million or 5.5% from December 2024. Growth was concentrated in:

- Residential mortgages: +$30.1M

- Farmland secured loans: +$29.0M

- Non-owner occupied CRE: +$16.2M

- Owner occupied CRE: +$10.5M

- Multifamily: +$8.0M

These gains offset declines in automobile loans (-$27.2M) and construction/land development (-$19.0M).

Total deposits grew $50.1 million (4.2%) to $1.25 billion, with noninterest-bearing deposits up $19.1 million.

What Did Management Say?

CEO Mike Wilkerson emphasized execution and fundamentals:

"We continue to execute consistently and focus on the fundamentals of running a growth-oriented bank, while maintaining safety and soundness. Once again, we achieved positive results for the fourth quarter and for the year ended December 31, 2025 in the key categories of net income, net interest margin, yield on earning assets, cost of funds, return on average equity, return on average assets, and the Bank's leverage ratio."

On book value improvement:

"As a result of being resolute in our efforts, book value and tangible book value of F&M shares increased for the fourth consecutive quarter, and as of December 31, 2025, was $29.46 and $28.58, respectively. The year-over-year increase in book value was 20.6%, or $5.03 per share."

How Is Credit Quality Trending?

Asset quality improved during the year:

The allowance for credit losses declined to $7.8 million from $8.1 million, reflecting the shift in loan mix toward lower-risk categories like farmland and residential mortgages.

Q4 2025 provision for credit losses was $1.1 million, up from $539,000 in Q3, driven by loan growth and $1.1 million in net charge-offs.

Capital and Liquidity Position

The bank maintains strong capital ratios:

Shareholders' equity increased $18.7 million to $104.8 million, driven by retained earnings ($11.2M net income less $3.7M dividends) and $10.8 million improvement in other comprehensive income from the bond portfolio.

On-balance sheet liquidity totaled $289 million at year-end, up from $243 million, with additional off-balance sheet capacity of $270 million through FHLB ($180M) and Fed discount window ($115M pledged securities).

Dividend Declared

The Board declared a quarterly dividend of $0.26 per share, payable March 2, 2026 to shareholders of record February 14, 2026. At the recent trade price of $30.59, this represents a 3.40% annualized yield.

How Did the Stock React?

FMBM shares have been on a strong run, gaining 53% over the past year from ~$20 in early 2025 to $30.59 — trading near the 52-week high of $30.95.

The stock trades at a modest 1.04x book value despite the strong performance, reflecting the limited liquidity typical of OTCQX-traded community banks.

What Changed From Last Quarter?

Positives:

- Net interest income up $565K sequentially (+5%)

- Net interest margin expanded 4 bps to 3.40%

- Book value increased $0.94 per share (3.3%)

- Fourth consecutive quarter of book value growth

Mixed:

- Net income down $41K from Q3 due to higher operating expenses

- Provision increased to $1.1M from $539K

- Operating expenses up $141K sequentially

Notable Q4 Events:

- Issued $10M subordinated debt at 7.55% fixed-to-floating rate

- Redeemed $7M of outstanding subordinated debt

- Received $98K trailing gain from 2022 Infinex partnership sale

Key Takeaways

- Record Year: FY 2025 net income of $11.2M was the company's best ever, up 53% YoY

- Margin Story: NIM expansion of 57 bps drove results — asset yields up while funding costs down

- Strong Capital: Book value surged 21% YoY to $29.46; tangible book value at $28.58

- Quality Holding: NPL ratio improved to 0.68% from 0.84% despite loan growth

- Shareholder Returns: $0.26 quarterly dividend provides 3.4% yield; stock up 53% over past year

The Shenandoah Valley-based bank continues to benefit from its focus on relationship banking and agricultural/residential lending in its home markets, delivering steady growth while maintaining conservative underwriting standards.

F&M Bank Corp. is a Virginia-based bank holding company operating Farmers & Merchants Bank with 14 branches across Rockingham, Shenandoah, and Augusta counties, Virginia, plus offices in Winchester and Waynesboro.